2023.11.27 Hyundai Motor Company

Hydrogen Inside 3

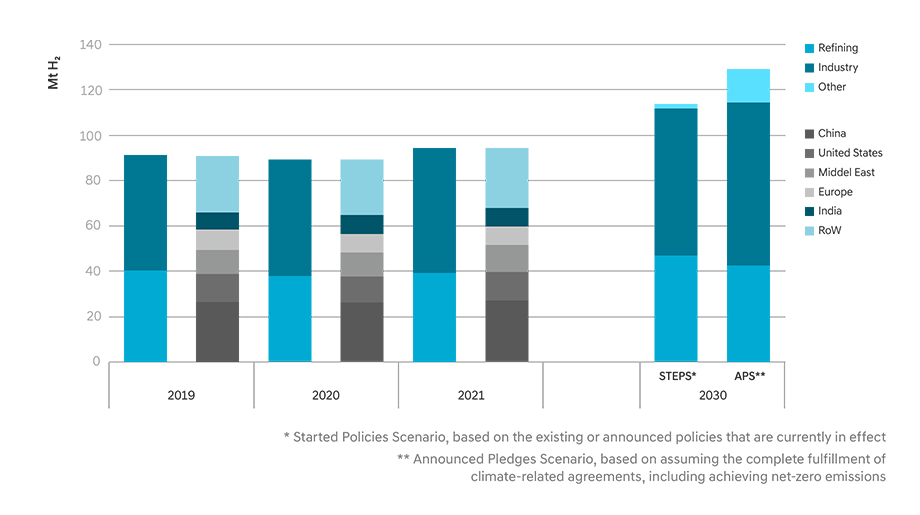

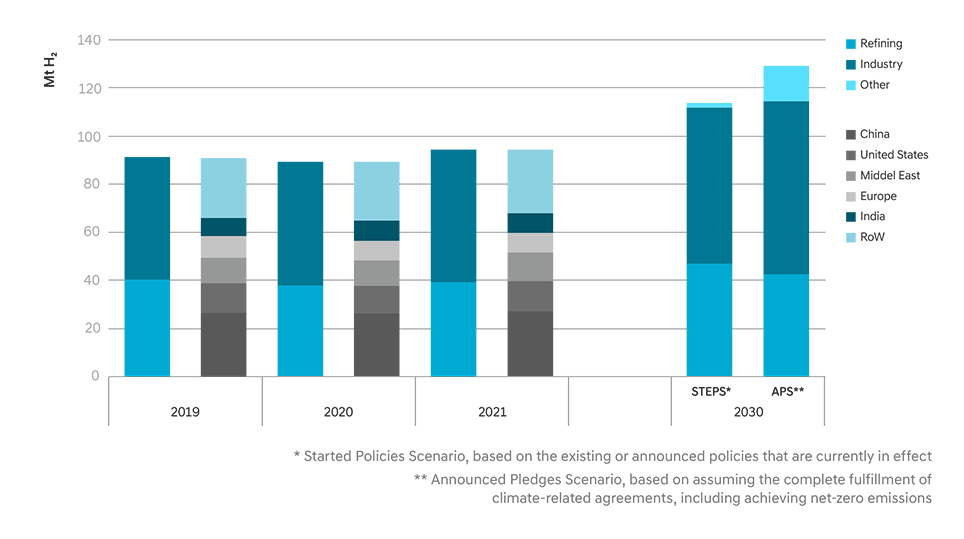

Figure 1 shows the hydrogen demand in different sectors and regions from 2019 to 2021, along with projections for 2030. The data from 2019 to 2021 shows that hydrogen is predominantly used in the refining and industrial sectors.

What about the outlook for 2030? Based on the STEPS (Stated Policies Scenario), hydrogen demand is expected to increase slightly. However, a significant difference is expected under the APS (Announced Policy Scenario). This difference is mainly due to the increase in the 'Other' category, which represents new hydrogen demand for applications including hydrogen mobility and power generation.

With growing interest in carbon-neutral policies, we expect a consistent expansion in the exploration of new uses for hydrogen.

To accelerate the transition to a Hydrogen Society, it requires us to actively consider expanding new hydrogen demands and creating innovative and different hydrogen demands. Continuous technological developments and investments in the mobility and hydrogen power sectors are essential, and a step-by-step approach to stimulate hydrogen demand is also indispensable.

According to the above figure, the demand for hydrogen is primarily divided between the oil refining and industrial sectors. But how is hydrogen used in these sectors? Let's explore this in more detail.

Hydrogen is used in refining crude oil, specifically for sulfur removal. Sulfur in fuel emits harmful pollutants when combusted. Regulations limiting the sulfur content in fuel have been consistently enhanced to protect the environment. The desulfurization process is essential for meeting these quality standards, and it consumes a substantial amount of hydrogen.

Hydrogen is also used as an ingredient in various chemical productions. The majority of hydrogen's use is for ammonia (NH3) production, and a substantial portion is for methanol (CH3OH) production.

In order to meet the increasing hydrogen demand, a range of hydrogen utilization technologies are currently under development. In particular, Hydrogen mobility and hydrogen power generation have emerged as prominent sectors receiving a lot of attention.

In the mobility sector, FCEVs such as existing passenger/commercial vehicles have already reached the commercialization phase.

Hyundai pioneered the commercialization of FCEV in 2013 by launching the 'Tucson ix 35 Fuel Cell', the world's first mass-produced FCEV. Then, with the release of 'NEXO' in 2018, Hyundai seized the title of the world’s best-selling FCEV. Hyundai is now extending its mobility lines releasing diverse FCEVs including fuel cell trucks and fuel cell buses.

Establishment of the Hydrogen Fuel Cell Development

Development of Exclusive System

TUCSON ix35 Fuel Cell

NEXO

XCIENT FC Truck

ELEC CITY FC Bus

N Vison 74 Rolling Lab

Universe FC Bus

XCIENT FC Tractor

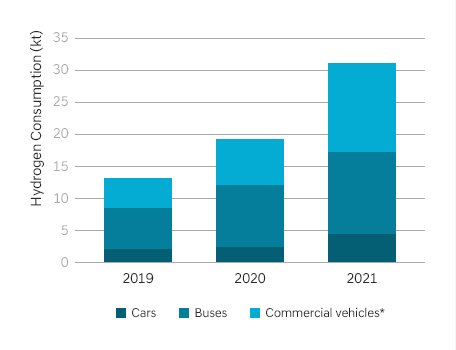

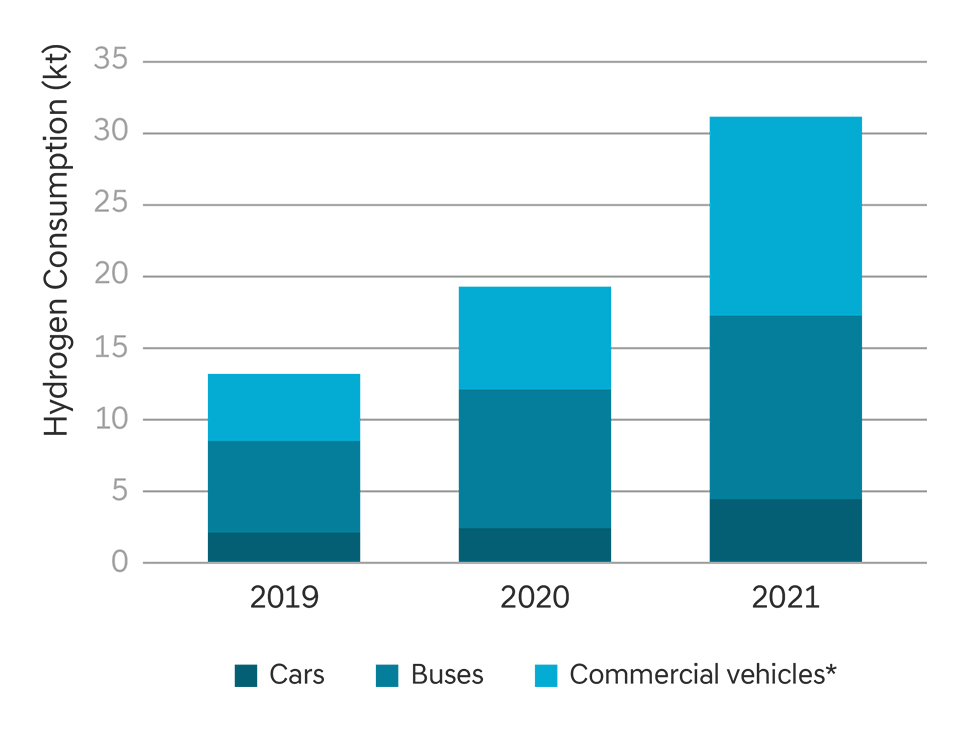

According to figure 2 conducted by the IEA, we can observe the hydrogen consumption in the passenger car, bus, and commercial vehicle sectors from 2019 to 2021. The blue area represents hydrogen consumption in cars, the green area represents buses, and the mint-colored area represents commercial vehicles.

Particularly in the mobility sector, there has been a consistent increase in hydrogen consumption. Buses and commercial vehicles, being larger in size compared to passenger cars, have consumed relatively larger amounts of hydrogen.

With the development of various hydrogen mobility solutions, it is expected that hydrogen consumption in the mobility sector will continue to rise.

In the future, the utility of hydrogen is expected to increase in the power generation sector as well. Hyundai Motor Company has manufactured a hydrogen fuel cell power generation system based on the Hydrogen Fuel Cell System used in Nexo. This innovative power system isn't limited to just vehicle charging; it's also adaptable to mainstream power generation infrastructure.

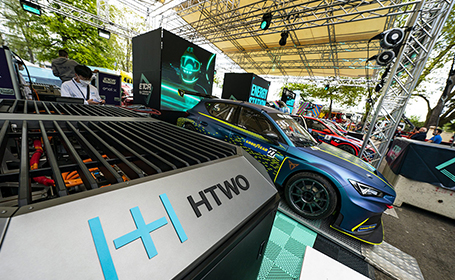

Hyundai Motor Company introduced a mobile Fuel Cell Generator for the ETCR (Electric Touring Car Racing), the first electric touring car championship in 2021. This 160kW generator offered a mobile charging infrastructure utilizing fuel cell technology to charge high-performance EVs participating in the race.

Additionally, Hyundai established a 1MW-class hydrogen fuel cell power generation system within the Ulsan Thermal Power Plant. This cutting-edge system, built on domestic technology, comprised two container modules with a combined power capacity of 500kW, capable of generating an annual output of 8,000MWh.

This hydrogen fuel cell power generation system is environmentally friendly and operates as a decentralized form of power generation, producing small to medium-scale electricity in proximity to energy-consuming areas. Furthermore, the potential to expand the supply capacity to tens or even hundreds of MW is within reach based on the number of containers.

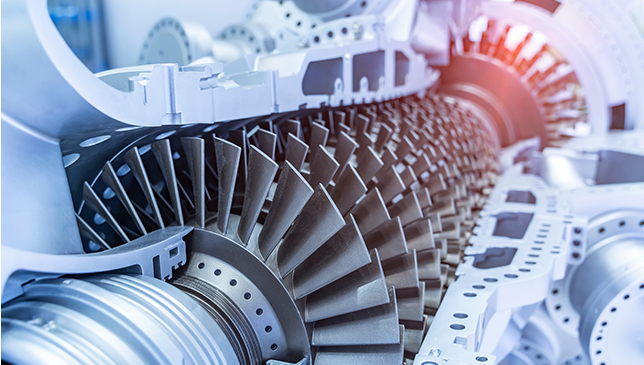

In addition to fuel-cell-based power generation that utilizes hydrogen's oxidation-reduction reaction, hydrogen can also be used as fuel for turbine generators. This typically involves a process in which hydrogen and Liquefied Natural Gas (LNG) are combusted together, known as Hydrogen mixed combustion.

Also, hydrogen can be used for production of metal which is Hyrogen DRI* Indeed, the application of hydrogen energy can reach far beyond our expectations. We look forward to seeing the use of hydrogen energy not just in mobility, but across a range of diverse sectors.

* Hydrogen DRI(Direct Reduced Iron) : Iron is produced through the reduction of oxygen in iron ore using hydrogen gas as the reductant instead of coal gas.