2023.11.28 Hyundai Motor Company

Hydrogen Inside 4

In order to promote the advancement of the hydrogen industry, policy support is essential. Addressing public skepticism about hydrogen’s potential to replace conventional energy sources is crucial, and fostering a national consensus to alleviate such doubts is vital. Therefore, presenting a national hydrogen vision and generating momentum for the transition to a hydrogen society are necessary steps.

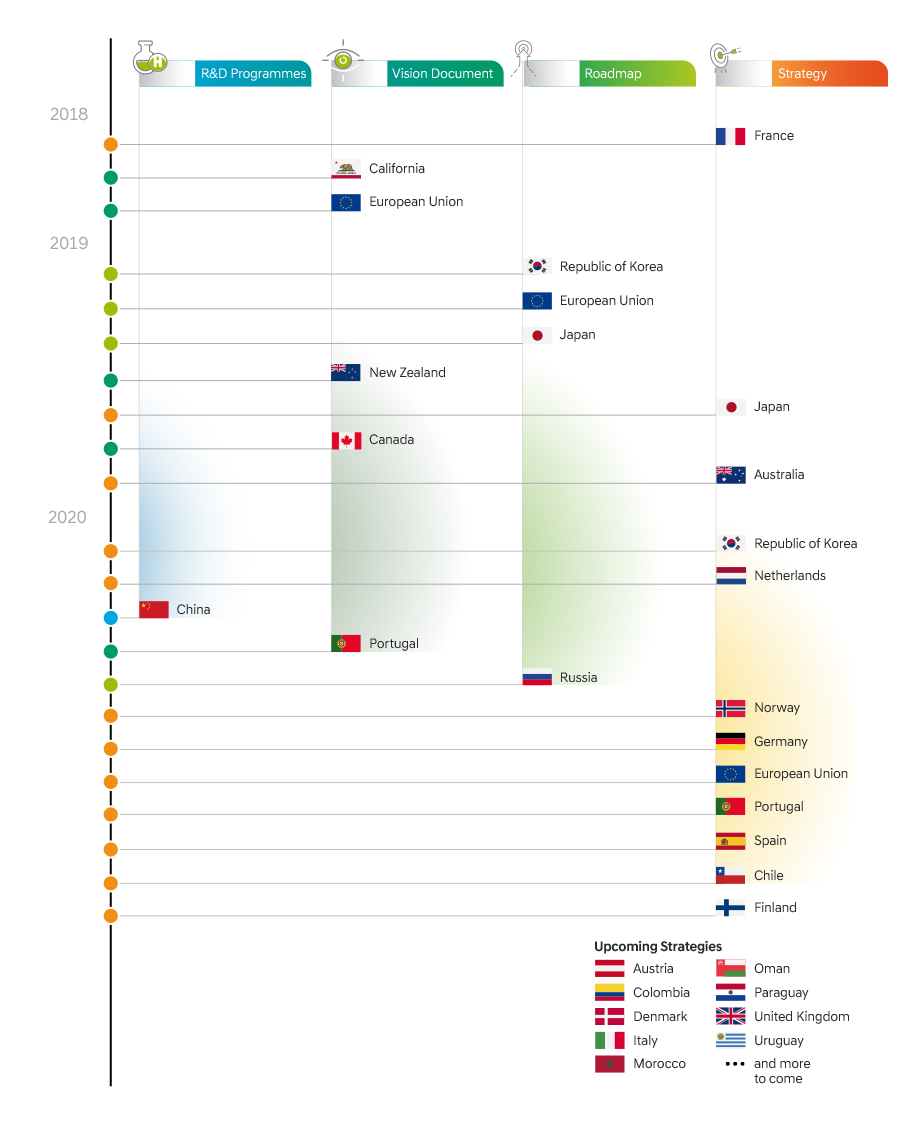

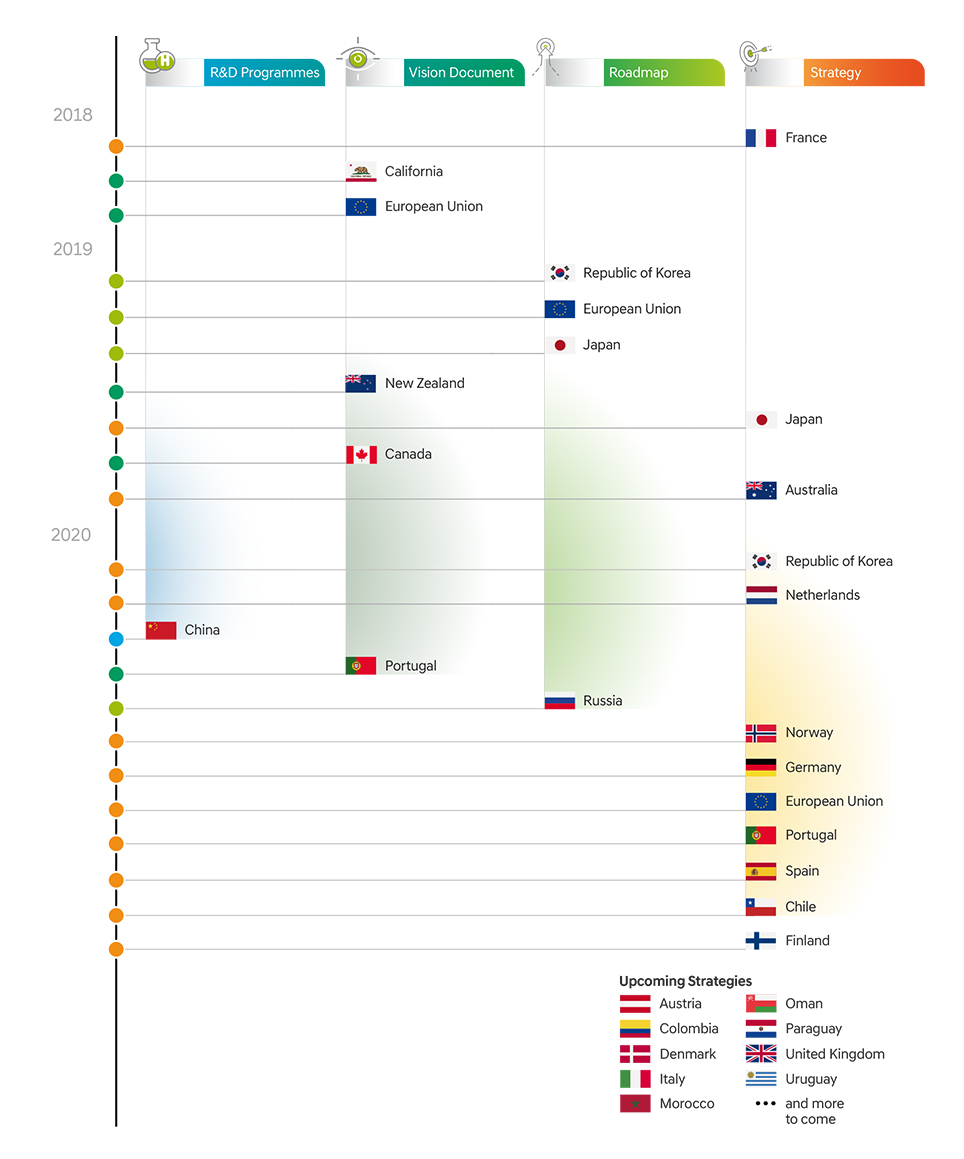

Figure 1 is a chart summarizing the government hydrogen-related initiatives announced between 2018 and 2020 by each country. The chart organizes countries based on their announcements of research and development programs, hydrogen visions, roadmaps, and strategies, arranged chronologically.

Figure 1 indicate that an increasing number of countries are adopting or preparing national-level hydrogen strategies. Presenting macro-level guidance for the hydrogen industry through policy measures and generating momentum for hydrogen industry activation are becoming global trends.

At present, there is an unstable hydrogen demand, leading to the adoption of policies for expanding hydrogen demand to stimulate hydrogen supply and facilitate the overall activation of the hydrogen value chain.

1. Increase in H2 demand,

ease of securing

H2 off-takers

2. Mitigation of H2

production/distribution

project risks

3. Increase in investment in

H2 production/distribution

facilities

4. Technological advancement

and process scale-up due to

facility investment

5. Cost reduction

and increased

project profitability

6. Increase in H2 project

development, vitalization of the

H2 value chain

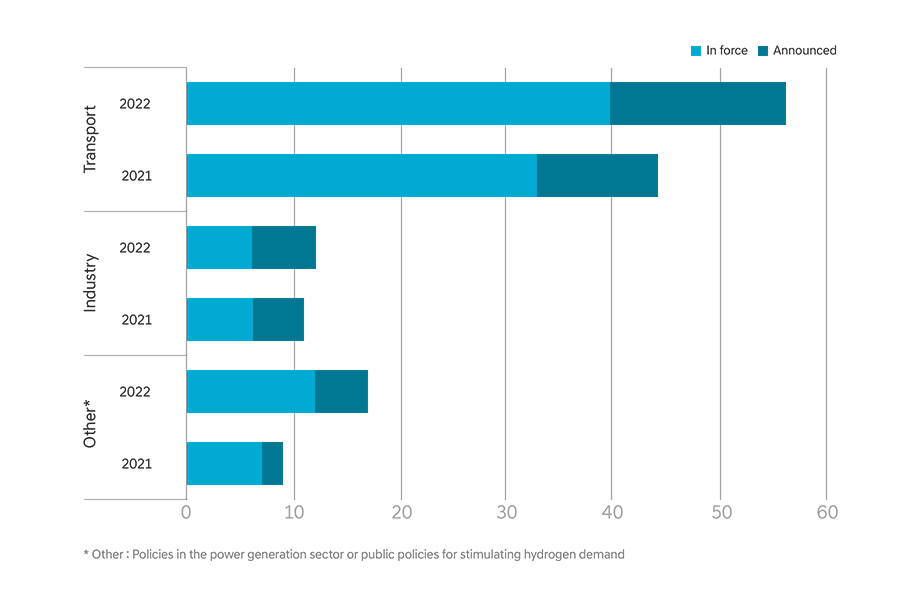

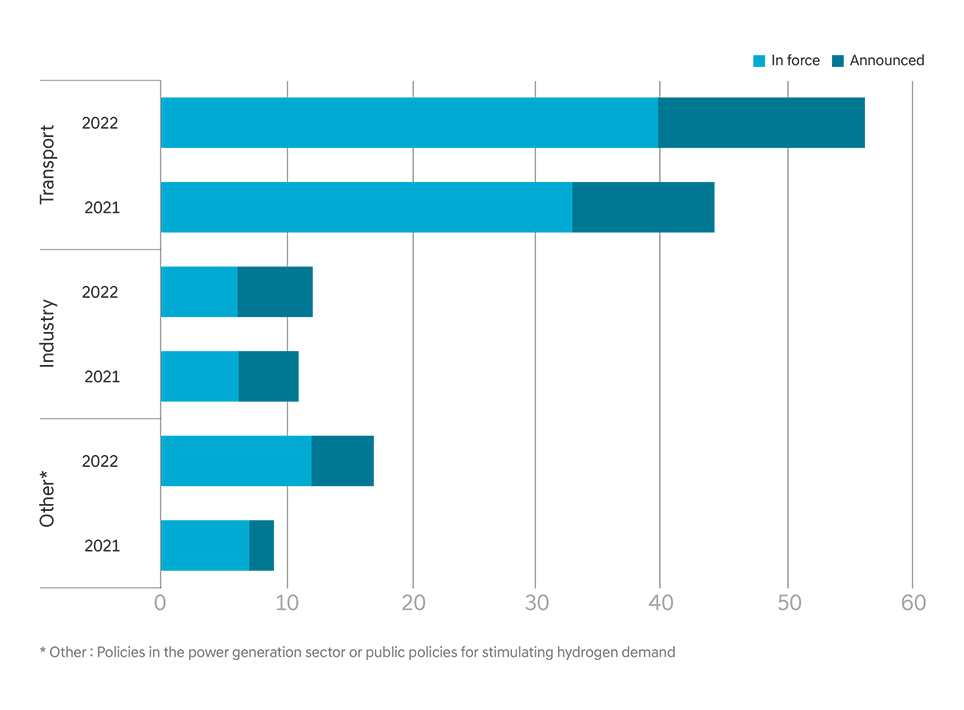

Figure 2 is a chart showing the status of policies related to securing hydrogen demand announced or implemented from 2021 to 2022. The policies in force are colored in light blue, while the announced policies are in blue. It illustrates that there is a consistent increase in policies aimed at securing hydrogen demand. The chart also highlights that a high number of existing policy supports are related to the transport sector.

The reason for the transport sector receiving more policy support than other sectors is likely due to its relatively rapid commercialization. As we've seen with Hyundai's FCEV lineup, there has been significant progress in commercializing the mobility sector, particularly in vehicles. In such a situation, additional policy support would further increase the demand for hydrogen compared to other sectors.

In the future, if commercialization is achieved in other sectors as well, policy support for those sectors could increase. Additionally, To generate large-scale demand in the future, proactive policy support will be necessary not only in the transport sector but also in the industrial sector.

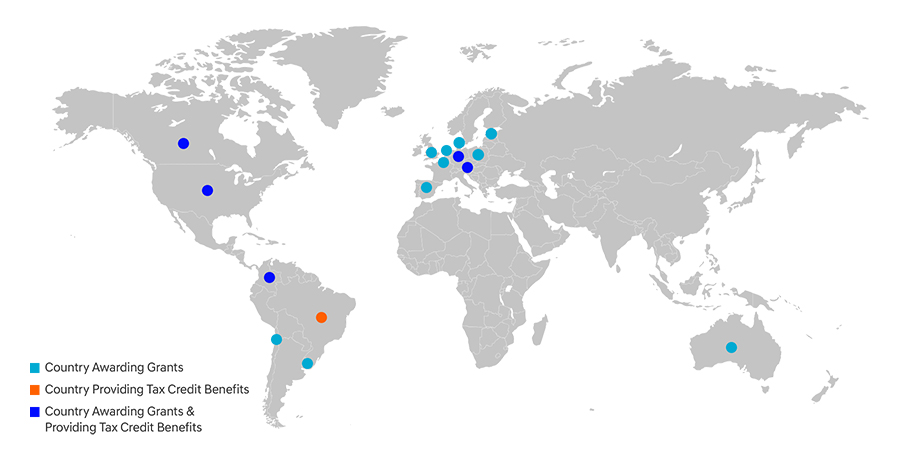

As of now, the hydrogen business is perceived as a risky new venture for companies, due to the limited market demand and lower technological maturity compared to other industries. Hence, policy plays a crucial role in creating an environment that enables the participation of numerous companies in the hydrogen industry. Policy support, such as providing grants through various funding and offering tax incentives for investments, is necessary to mitigate investment risks for companies.

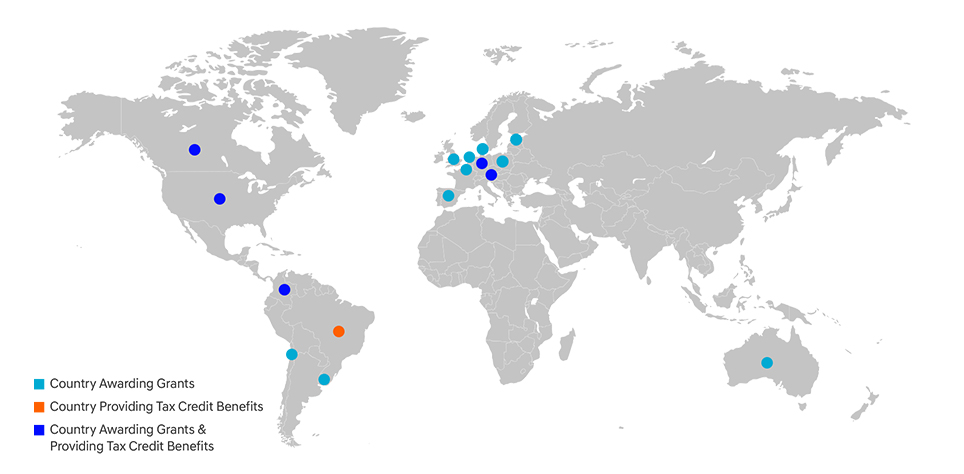

The map below shows the countries that have implemented or announced policies to mitigate risks and provide support for hydrogen projects between 2021 and 2022. You can check the current status of grant funding or tax credit policies of each country by clicking on the relevant section.

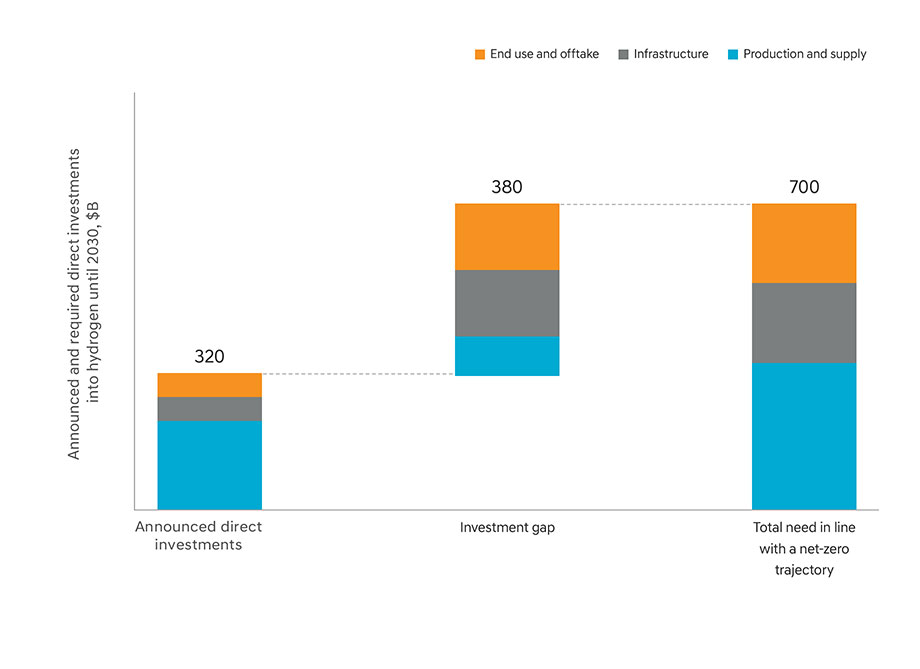

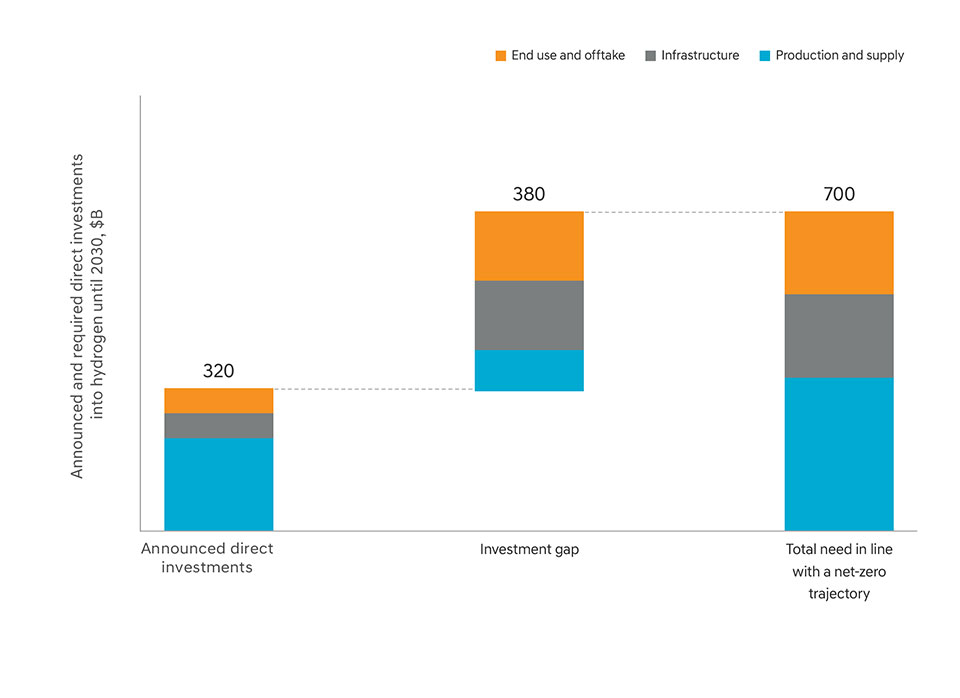

Fig. 3 shows the amount of additional investment needed in hydrogen to achieve carbon neutrality in 2030. As you can see on the left, the announced investment so far is $320 billion. the investment gap indicates that an additional $380 billion in investment is needed to achieve carbon neutrality.

This suggests that much more investment is needed in the hydrogen sector than has been made until now.

The hydrogen business still carries high risks and is in the early stages of the value chain, leading companies and individuals to perceive it as a business in the remote future. However, hydrogen-related technologies are rapidly advancing, and as a result, countries are striving to respond swiftly with proactive policy measures and support.

With growing public awareness of the significance of hydrogen and the backing of government support and corporate investments, the momentum for the hydrogen industry can be established, making a hydrogen society an achievable reality in the near future.